Introduction

- International Education Standard (IES) 8 prescribes the professional competence that professional accountants are required to develop and maintain when performing the role of an Engagement Partner responsible for audits of financial statements. For the purpose of IES 8, hereafter referred to as "Engagement Partner" per the definition set out in the International Standard on Auditing (ISA) 220, Quality Control for an Audit of Financial Statements 1.

- IES 8 is addressed to International Federation of Accountants (IFAC) member organizations. IFAC member organizations have a responsibility for the Continuing Professional Development (CPD) of professional accountants, and for fostering a commitment to lifelong learning among professional accountants. Under IES 7, Continuing Professional Development (2020)2, IFAC member organizations require professional accountants to develop and maintain professional competence necessary to perform their role as a professional accountant. IES 8 applies IES 7 requirement to the role of an Engagement Partner. It is the responsibility of the professional accountant performing the role of an Engagement Partner to develop and maintain professional competence by undertaking relevant CPD activities, which include practical experience.

- IES 8 is intended to be read in conjunction with Statement of Membership Obligations (SMO) 1 - Quality Assurance, International Standard on Auditing (ISA) 220 (Revised), Quality Management for an Audit of Financial Statements, International Standard on Quality Management (ISQM) 1, Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or Other Assurance or Related Services Engagements, and International Standard on Quality Management (ISQM) 2, Engagement Quality Reviews. Together, these pronouncements place responsibilities on IFAC member organizations, Engagement Partners, and firms as part of the system of quality management for audits of financial statements. Also, in many jurisdictions, a regulator may have an oversight role in this system of quality management. Each of these stakeholders may have an impact on the professional competence of the Engagement Partner.

- IFAC member organizations or other stakeholders may also apply the requirements of IES 8 to professional accountants performing an equivalent role to that of an Engagement Partner on audits of other historical financial information in compliance with the ISA (or other relevant auditing standards) or other types of engagements providing assurance and related services.

- Definitions and explanations of the key terms used in the IES and the Framework for International Education Standards for Professional Accountants and Aspiring Professional Accountants (2015) are set out in the Glossary of Terms for International Education Standards (2026). Additional terms from the International Auditing and Assurance Standards Board (IAASB) pronouncements are also included in the Explanatory Material.

1 For the purpose of IES 8, hereafter referred to as "Engagement Partner" per the definition set out in International Standard on Auditing (ISA) 220 (Revised), Quality Control for an Audit of Financial Statements, Para. 12(a).

2 IES 7, Continuing Professional Development (2020), Para. 9.

References to Definitions Contained within IAASB Pronouncements

- IES 8 uses the following terms already defined within IAASB pronouncements4.

4 The ISA definitions detailed above are contained within the IAASB Handbook of International Quality Management, Auditing, Review, Other Assurance, and Related Services Pronouncements - 2023-2024 Edition, Volume I.

|

Auditor's Expert |

ISA 620 - Using the Work of an Auditor's Expert, Paragraph 6(a). |

An individual or organization possessing expertise in a field other than accounting or auditing, whose work in that field is used by the auditor to assist the auditor in obtaining sufficient appropriate audit evidence. An auditor's expert may be either an auditor's internal expert (who is a partner or staff, including temporary staff, of the auditor's firm or a network firm), or an auditor's external expert. |

|

Engagement Partner* |

ISA 220 (Revised) - Quality Management for an Audit of Financial Statements, Paragraph 12 (a). |

The partner* or other individual, appointed by the firm, who is responsible for the audit engagement and its performance, and for the auditor's report that is issued on behalf of the firm, and who, where required, has the appropriate authority from a professional, legal or regulatory body. |

|

Engagement Team |

ISA 220 (Revised) - Quality Management for an Audit of Financial Statements, Paragraph 12 (d). |

Engagement team - All partners and staff performing the audit engagement, and any other individuals who perform audit procedures on the engagement, excluding an auditor's external expert and internal auditors who provide direct assistance on an engagement5. |

|

Financial Statements |

ISA 200 - Overall Objective of the Independent Auditor, and the Conduct of the Audit in Accordance with International Standards on Auditing, Paragraph 13 (f). |

A structured representation of historical financial information, including disclosures, intended to communicate an entity's economic resources or obligations at a point in time, or of the changes therein. For a period of time, in accordance with a financial reporting framework. The term "financial statements" ordinarily refers to a complete set of financial statements as determined by the requirements of the applicable financial reporting framework, but can also refer to a single financial statement. Disclosures comprise explanatory or descriptive information, set out as required, expressly permitted or otherwise allowed by the applicable financial reporting framework, on the face of a financial statement, or in the notes, or incorporated therein by cross-reference. |

|

Firm* |

ISA 220 (Revised)- Quality Management for an Audit of Financial Statements, Paragraph 12 (e). |

A sole practitioner, partnership or corporation or other entity of professional accountants, or public sector equivalent. |

|

Professional Judgment |

ISA 200 - Overall Objective of the Independent Auditor, and the Conduct of the Audit in Accordance with International Standards on Auditing, Paragraph 13 (k). |

The application of relevant training, knowledge and experience, within the context provided by auditing, accounting and ethical standards, in making informed decisions about the courses of action that are appropriate in the circumstances of the audit engagement. |

|

Professional Skepticism |

ISA 200 - Overall Objective of the Independent Auditor, and the Conduct of the Audit in Accordance with International Standards on Auditing, Paragraph 13 (l). |

An attitude that includes a questioning mind, being alert to conditions which may indicate possible misstatement due to error or fraud, and a critical assessment of audit evidence. |

* "Engagement partner," "partner," and "firm" is to be read as referring to their public sector equivalents where relevant.

5 ISA 610, Using the Work of Internal Auditors (Revised 2013), Using the Work of Internal Auditors, establishes limits on the use of direct assistance. It also acknowledges that the external auditor may be prohibited by law or regulation from obtaining direct assistance from internal auditors. Therefore, the use of direct assistance is restricted to situations where it is permitted.

Scope of this Standard

- Professional competence can be described and categorized in many different ways. Within IES 8, professional competence is the ability to perform a role to a defined standard. Professional competence goes beyond knowledge of principles, standards, concepts, facts, and procedures; it is the integration and application of: (a) technical competence, (b) professional skills, and (c) professional values, ethics, and attitudes.

- CPD is a continuation of Initial Professional Development (IPD). IPD is the learning and development through which individuals first develop competence leading to performing the role as a professional accountant. CPD is learning and development that takes place after IPD, and that develops and maintains professional competence to enable professional accountants to continue to perform their roles competently. CPD provides continuous development of: (a) technical competence, (b) professional skills, and (c) professional values, ethics, and attitudes achieved during IPD, refined appropriately for the professional activities and responsibilities of the professional accountant.

- As outlined in IES 7 6, CPD includes practical experience. As the career of an Engagement Partner progresses, practical experience becomes increasingly important in developing and maintaining the necessary depth and breadth of professional competence. Practical experience for Engagement Partners may be evidenced by annual self-declarations, records of chargeable time, and the results of qualitative monitoring activities such as performance reviews, engagement quality assurance reviews and regulatory inspections.

- In addition to professional competence and practical experience, other factors outside the scope of IES 8 determine whether a professional accountant has, where required, the appropriate authority from a professional, legal, or regulatory organization to perform the role of Engagement Partner.

- In many jurisdictions, legislation, regulation, or a regulator (referred to collectively as a "licensing regime") sets or enforces the requirements as to who may perform the role of an Engagement Partner. Licensing regimes vary widely in their requirements. Where licensing is not within the authority of the IFAC member organization, IFAC member organizations shall use their best endeavors as described in SMO 2 -International Education Standards for Professional Accountants and Aspiring Professional Accountants7 to influence the licensing regime so that the IFAC member organization can meet the professional competence requirements set out in IES 8.

- A firm, which by definition includes sole practitioners, determines who can issue an audit opinion as a legal representative of that firm. Most firms operate in a partnership structure, and the partners in the partnership decide who in that firm can perform the role of Engagement Partner.

6 See IES 7, Continuing Professional Development (2020), Para. 2.

7 Statement of Membership Obligations 2 - International Education Standards for Professional Accountants and Aspiring Professional Accountants sets out the requirements of an IFAC member organization with respect to these International Education Standards. The SMO specifically addresses the situation where an IFAC member organization has no responsibility or shared responsibility for adopting and implementing professional accounting.

Stakeholders That Impact the Professional Competence of Engagement Partners

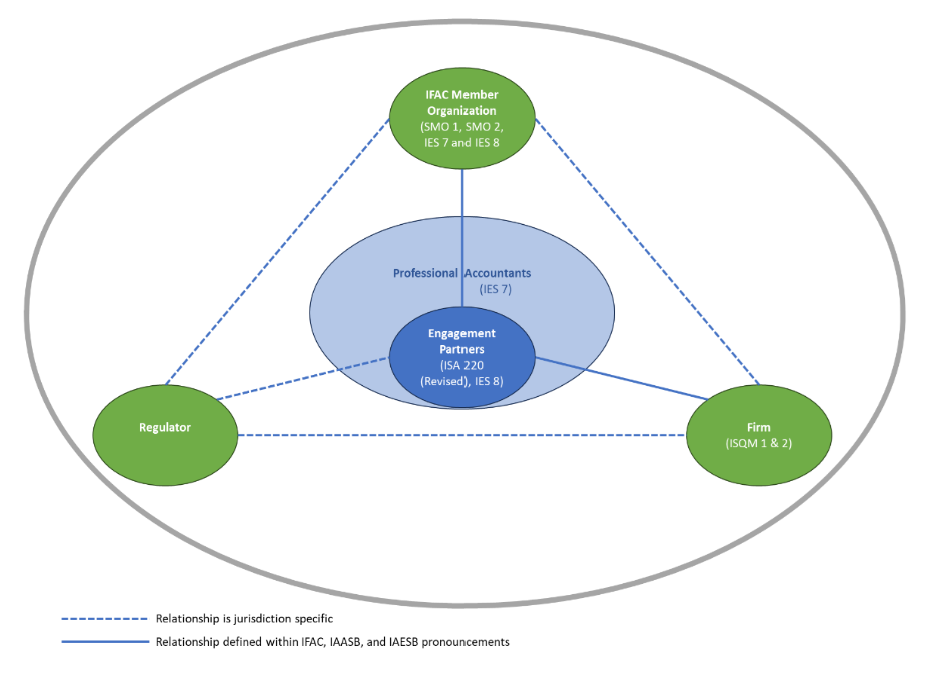

- Figure 1 illustrates stakeholders that impact the professional competence of Engagement Partners. Relationships between stakeholders can be dependent on the jurisdiction or as a consequence of requirements contained in ISA and IES and obligations contained in IFAC pronouncements.

- In accordance with IES 78, IFAC member organizations require professional accountants to undertake and record relevant CPD that develops and maintains professional competence necessary to perform their role as a professional accountant.

8 See IES 7, Continuing Professional Development (2020), Para. 9.

Figure 1: Stakeholders That Impact the Professional Competence of Engagement Partners

- IES 79 also requires IFAC member organizations to establish a systematic process to monitor whether professional accountants meet the IFAC member organization's CPD requirements.

- ISA 220 (Revised)10 addresses the responsibilities of the Engagement Partner with respect to whether the engagement team and any auditor's experts who are not part of the team, collectively have the appropriate competence, capabilities and sufficient time. Unless information provided by the firm or other parties suggest otherwise, ISA 220 (Revised)11 indicates that the engagement team may rely on the firm's system of quality management in relation to the competence of personnel through their recruitment and formal training.

- ISQM 112 requires the firm to establish quality objectives that address appropriately obtaining, developing, using, maintaining, allocating and assigning resources in a timely manner to enable the design, implementation and operation of the system of quality management.

- In many jurisdictions, regulators may have an oversight role in relation to IFAC member organizations, firms, and Engagement Partners.

- By complying with the requirements of IES 8 and fulfilling their obligations under SMO 113 and SMO 214, IFAC member organizations assist firms in complying with the requirements of ISQM 1 and assist Engagement Partners in complying with the requirements of ISA 220 (Revised). Collectively these pronouncements promote clarity and consistency with respect to the professional competence required of the Engagement Partner and the engagement team, which serves to protect the public interest.

9 See IES 7, Continuing Professional Development (2020), Para. 16.

10 See ISA 220 (Revised), Quality Management for an Audit of Financial Statements, Para. 14.

11 See ISA 220 (Revised), Quality Management for an Audit of Financial Statements, Para. A2.

12 See ISQM 1, Quality Management for Firms that Perform Audits or Reviews of Financial Statements or Other Assurance or Related Services Engagements, Para. 32.

13 Statement of Membership Obligations 1 - Quality Assurance sets out the requirements of an IFAC member organization with respect to quality assurance review systems for its members who perform audits, review and other assurance and related services engagements of financial statements. The SMO specifically addresses the situation where an IFAC member organization has no responsibility or shared responsibility for setting the rules and operating the quality assurance review system.

14 Statement of Membership Obligations 2 - International Education Standards for Professional Accountants and Aspiring Professional Accountants sets out the requirements of an IFAC member organization with respect to these International Education Standards. The SMO specifically addresses the situation where an IFAC member organization has no responsibility or shared responsibility for adopting and implementing professional accounting.

Progressive Nature of Professional Competence

- Only those professional accountants who develop and maintain the professional competence that is demonstrated by achievement of the learning outcomes listed in requirement 8 will be able to deal with the complex situations that Engagement Partners may face during their careers. A professional accountant aspiring to be an Engagement Partner will usually serve for several years on engagement teams and may progress through supervisory and managerial roles under the supervision of an Engagement Partner. This progression through increasing levels of responsibility is a common path through which a professional accountant may prepare to assume the role of an Engagement Partner. Those serving as an Engagement Partner develop and maintain their professional competence through leading or serving on audit engagements, and through other learning activities as part of their CPD.

Audit of Financial Statements and Other Assurance Engagements

- IES 8 is applicable to Engagement Partners responsible for the audits of financial statements. The professional competence that is demonstrated by the achievement of the learning outcomes in requirement 8 may also be helpful when performing audits of other historical financial information in compliance with the ISA or other types of assurance and related services. Similarly, much of the professional competence required for an audit of financial statements may be relevant to those Engagement Partners responsible for assurance engagements relating to non-financial statement information, such as environmental or social measures.

Effective Date

- IES 8 is effective from January 1, 2021.

Objective

- The objective of IES 8 is to establish the professional competence that professional accountants develop and maintain when performing the role of an Engagement Partner.

- Establishing the professional competence that professional accountants develop and maintain in performing the role of Engagement Partner serves several purposes. It protects the public interest; contributes to audit quality; enhances the work of Engagement Partners; and promotes the credibility of the audit profession.

- While a premise of IES 8 is that Engagement Partners have already developed the professional competence to assume that role, Engagement Partners operate in an environment of significant change. Pressure for change can come from many sources, including, but not limited to: (a) increased regulation, (b) developments in financial and non-financial reporting, (c) emerging technologies, (d) increasing use of business analytics, and (e) business complexity. Change requires Engagement Partners to maintain and further develop professional competence throughout their careers.

Requirements and Explanatory Material

- IFAC member organizations shall require professional accountants performing the role of an Engagement Partner to develop and maintain professional competence that is demonstrated by the achievement of learning outcomes including, but not limited to, those listed under the competence areas below.

- IFAC member organizations shall require professional accountants performing the role of an Engagement Partner to undertake CPD that develops and maintains the professional competence required for this role.

Learning Outcomes for the Professional Competence of an Engagement Partner

Expand each competence area to see the required learning outcomes.

|

(a) Audit |

|

|

(b) Financial accounting and reporting |

|

|

(c) Governance and risk management |

|

|

(d) Business environment |

|

|

(e) Taxation |

|

|

(f) Information and communications technologies |

|

|

(g) Business laws and regulations |

|

|

(h) Finance and financial management |

|

|

(i) Interpersonal and communication |

|

|

(j) Personal |

|

|

(k) Organizational |

|

|

(l) Commitment to the public interest |

|

|

(m) Professional skepticism and professional judgment |

|

|

(n) Ethical principles |

3 The Fundamental Principles, IESBA Handbook of the International Code of Ethics for Professional Accountants (including International Independence Standards) - 2024 Edition, Section 110. |

- Requirement 8 identifies the competence areas and related learning outcomes for (a) technical competence, (b) professional skills, and (c) professional values, ethics, and attitudes. A competence area is a category for which a set of related learning outcomes can be specified.

- Learning outcomes establish the content and depth of knowledge, understanding, and application required for each specified competence area. The achievement of learning outcomes is an output-based approach to measuring CPD. IES 7 provides further guidance in respect of the measurement of CPD15.

- IES 8 builds on the learning outcomes that describe the professional competence required by aspiring professional accountants by the end of IPD as outlined in IES 2, 3, and 416.

- Other factors in addition to the learning outcomes in requirement 8 may affect the nature, timing, and extent of planned CPD. These factors may include, but are not limited to: (a) an Engagement Partner's portfolio of audit engagements, (b) the extent of any changes in auditing and financial reporting standards, and (c) the impact of any changes in the content of other competence areas noted in requirement 8.

- Irrespective of the size or nature of the audit engagement, and the firm of the Engagement Partner providing the audit, a premise of IES 8 is that Engagement Partners continue to undertake CPD appropriate to the complexity of the audits for which they serve as Engagement Partners.

- IFAC member organizations may include additional competence areas or require Engagement Partners to achieve additional learning outcomes that are not specified in this IES. This may occur, for example, when an Engagement Partner audits specialized industries or transactions.

15 IES 7, Continuing Professional Development (2020), Para. A19-A27.

16 IES 2, Initial Professional Development - Technical Competence (2026); IES 3, Initial Professional Development - Professional Skills (2026); and IES 4, Initial Professional Development - Professional Values, Ethics, and Attitudes (2026).

Sole Practitioners and Small and Medium Practices

- By focusing on one specific role rather than an engagement team or firm structure, IES 8 recognizes the wide range of situations in which the Engagement Partner operates, including as a sole practitioner or within small and medium practices17. In these situations, the Engagement Partner may be operating without the support of an engagement team, including those engagement team members with specialist skills. As a consequence, the Engagement Partner may have direct involvement in the completion of a wider range of audit activities than would otherwise be the case.

17 IFAC describes SMPs as practices that exhibit the following characteristics: their clients are mostly SMEs; they use external sources to supplement limited in-house technical resources; and they employ a limited number of professional staff.

Audit - Learning Outcomes

- Leading the identification and assessment of risks of material misstatements includes consideration of:

- The risks identified by engagement acceptance and continuance procedures;

- An entity's ability to continue as a going concern;

- The risks of material misstatement due to fraud and error.

- Evaluating the response to the risks of material misstatements includes the process of approving or establishing an appropriate overall audit strategy.

- Evaluating whether the audit was performed in accordance with International Standards on Auditing or other relevant standards, and with relevant laws and regulations, includes:

- Concluding whether sufficient appropriate audit evidence has been obtained;

- Consideration of significant deficiencies in internal control and in other matters to be communicated to those charged with governance;

- Consideration of bias in management's estimates and other areas of judgment.

Organizational - Learning Outcomes

- Examples of areas where an auditor's expert may be used on an audit include, but are not limited to, taxation, ICT, legal, forensic accounting, valuations, actuarial services, and pensions.

Professional Skepticism and Professional Judgment - Learning Outcomes

- A key aspect of any audit is evaluating whether sufficient and appropriate audit evidence has been obtained to support the conclusions on which the auditor's opinion is based. Professional skepticism involves the application of a questioning mind for the critical assessment of audit evidence. The ISA also require Engagement Partners and their teams to exercise professional judgment in planning and performing an audit of financial statements. Professional judgment is exercised, for example, when challenging management assertions and assumptions contained within the financial statements, and when considering whether accounting standards are appropriately applied by an entity and determining an appropriate overall audit strategy.

- Planning effective CPD in the areas of professional skepticism and professional judgment involves due care and may include a blend of learning methods in which mentoring, reflective activity, and practical experience play a key role.

Tools for Implementation

![]()

Webcast – IES 8 Webcast Presentation: Engagement Partners

Why is IES 8 Needed? What are IES 8’s Important Features? Who Does IES 8 Affect? What Does IES 8 Regulate? How Is IES 8 Implemented by Engagement Partner?

![]()

Webcast – IES 8 Webcast Presentation: Firms

Why is IES 8 Needed? What are IES 8’s Important Features? Who Does IES 8 Affect? What Does IES 8 Regulate? How Is IES 8 Implemented?

![]()

Webcast – IES 8 Webcast Presentation: Member Bodies

Why is IES 8 Needed? What are IES 8’s Important Features? Who Does IES 8 Affect? What Does IES 8 Regulate? How Is IES 8 Implemented by public accounting firms and SMPs?

![]()

Video - The Importance of Professional Accounting Education and the Impact of IESs

What is professional accounting education and how does it differ from an accounting education program offered by a university? Why is professional accounting education important? How do the revised International Education Standards impact professional accounting education?

![]()

Video - An Overview of the International Education Standards

What are the International Education Standards and what do they regulate? Who is the target audience for International Education Standards? What is their level of authority?

![]()

FAQs – Questions and Answers. Implementation Support for IES 8, Professional Competence for Engagement Partners Responsible for Audits of Financial Statements

Overview Q&As; Member Body Q&As; Engagement Partner Q&As; Audit Firm Q&As.

![]()

A Public Accounting Firm Perspective

In the second of a three part video series, IAESB Technical Advisor David Simko discusses the implications of the board's recently released continuing professional development standard for public accounting firms.

![]()

All Professional Accountants Need to Include Skepticism in their Mindset

The IAESB Personal Perspectives Series shares insights from board members, technical advisors and other key stakeholders on some of the challenges affecting aspiring professional accountants and the importance of effective accountancy learning and development.

External Resource | ICAS and FRC

Skills, Competencies and the Sustainability of the Modern Audit

Stuart Turley, Christopher Humphrey, Anna Samsonova-Taddei, Javed Siddiqui, Margaret Woods, Ilias Basioudis, and Chrystelle Richard (Commissioned by ICAS and FRC).

External Resource | ICAS and FRC

The Capability and Competency Requirements of Auditors in Today’s Complex Global Business Environment

Karin Barac, Elizabeth Gammie, Bryan Howieson, and Marianne van Staden (Commissioned by ICAS and FRC).

Global Inventory of Regional and National Qualifications Frameworks 2019, Volume I: Thematic chapters

UNESCO Institute for Lifelong Learning (UIL); European Centre for Development of Vocational Training (Cedefop); European Training Foundation (ETF); United Nations Educational, Scientific and Cultural Organisation (UNESCO).

![]()

A Conversation on Professional Skepticism and Accountancy Education

Listen to a conversation on professional skepticism with Professors Joe Brazel, Christine Nolder, and Doug Prawitt discuss a range of issues, including the definition of professional skepticism; skills and behaviors important to its application; the involvement of the higher education sector in developing its underlying behavioral competencies; techniques used for its development within an education setting; and the involvement of other stakeholders in a global environment.